LIC Branches All India with LIC Branch code, LIC Branch Address, LIC Branch contact number, LIC Branch email id, LIC website, LIC premium payment online and mainly to help online search for other useful information on the web.

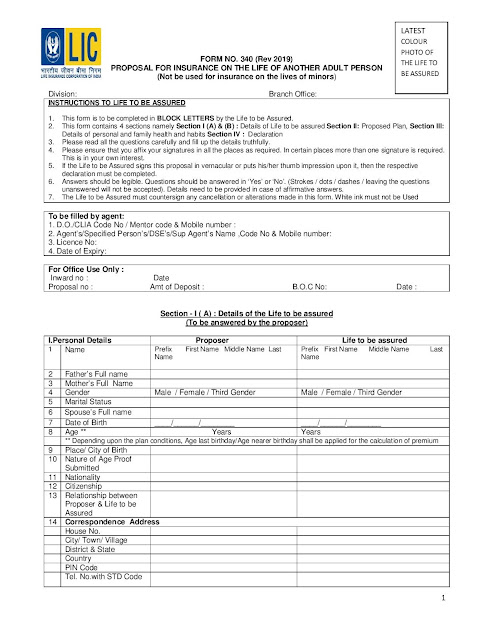

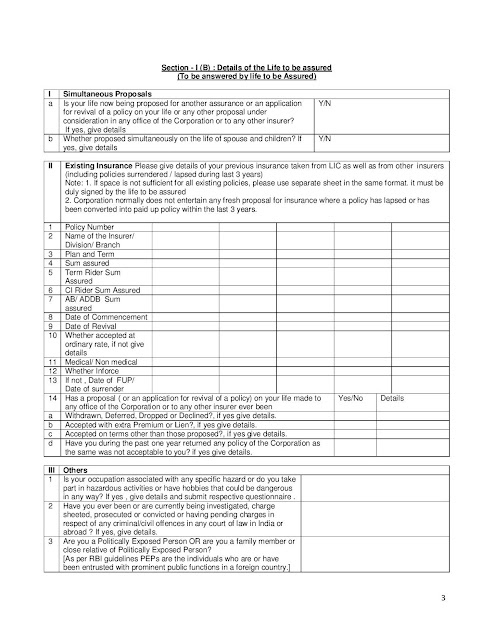

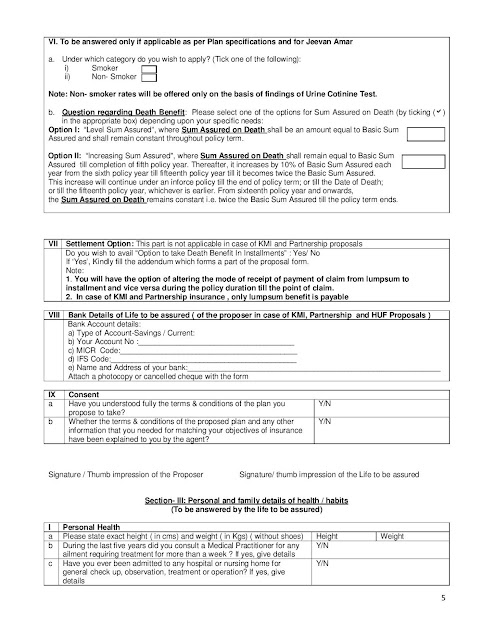

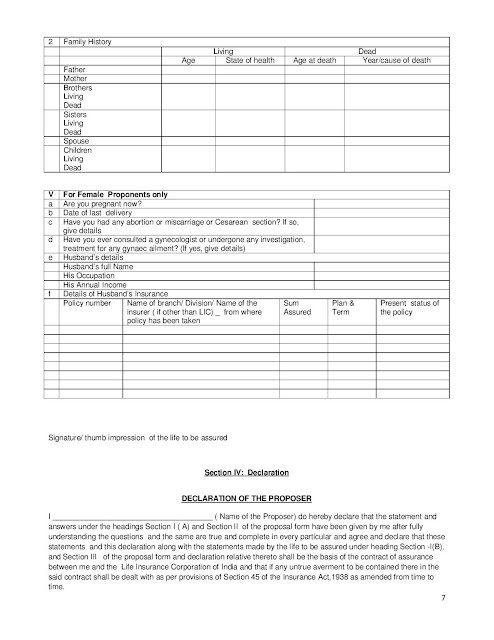

LIC Forms Download - LIC Form 340 - ( Rev. 2019 ) - Download LIC form now

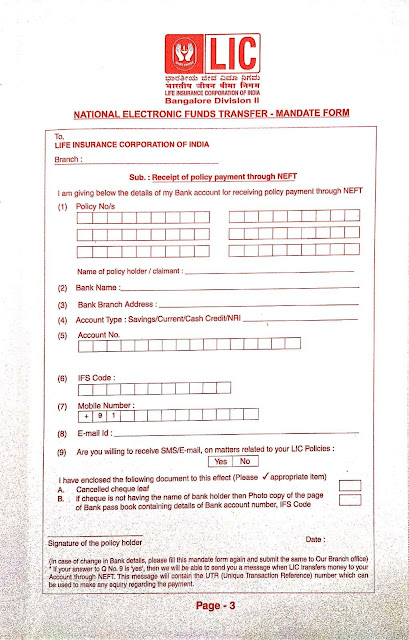

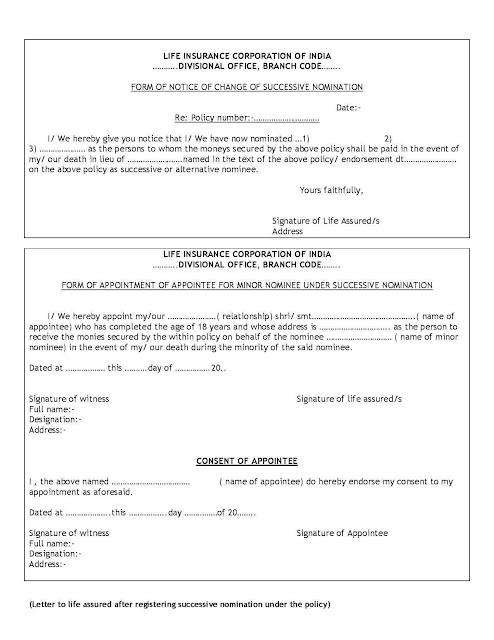

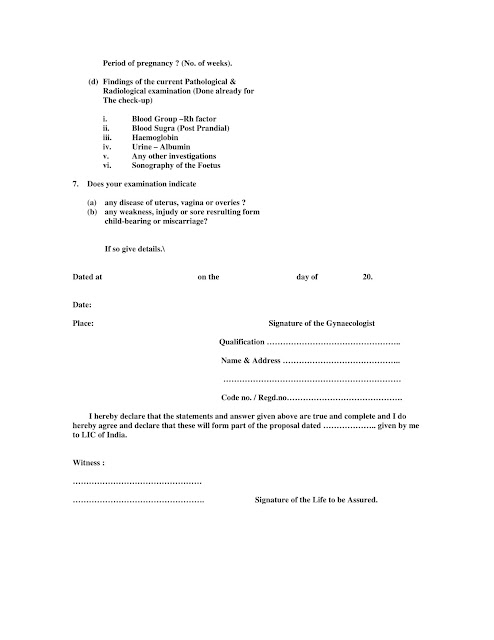

LIC Surrender forms full set - LIC form 3510/ 5074 Receipt of the Surrender Value of the policy - page 1&2 - Application for the surrender value - Questionnaire to e submitted with surrender application/ discharge form - LIC NEFT Form

LIC SURRENDER FORM FULL SET

You can save each page and take a printout or download pdf format from the link given at the end

LIC PLO 21 - SIGNATURE FORM

LIC SURRENDER FORM FULL SET - PDF DOWNLOAD

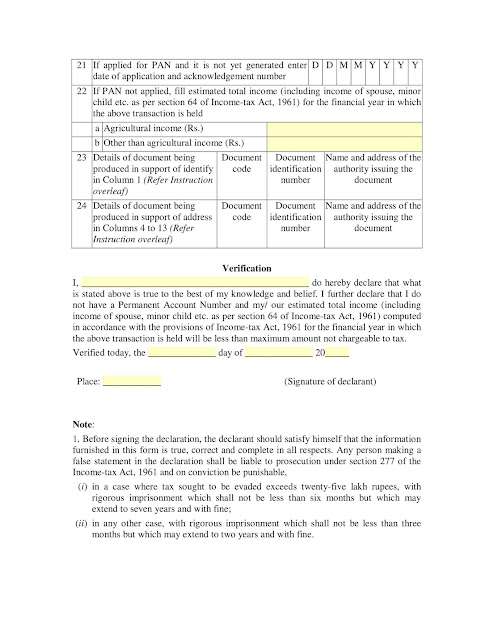

60C form - 5 pages - LIC forms download - Form of declaration to be filed by an individual or a person not having PAN number issued by Government of India

Form No: 60 Form of declaration from LIC of India to be filed by an individual or a person ( not being a company or firm ) who does not have a permanent Account number ( PAN ) and who enters into nay transaction specified in rule 114B

LIC form : 60C ( 5 pages )

DOWNLOAD LIC Maturity forms online - LIC forms PDF download - Documents required for submission - LIC forms download

LIC Maturity information and Forms

- Original LIC policy certificate,

- PAN Card copy

- One cancelled cheque with the policyholder's name embossed on it.

LIC MATURITY FORM - PDF - DOWNLOAD

LIC policyholders register your LIC policy online

LIC policyholders register your LIC policy online from home

Life Insurance Corporation of India (LIC) is one of India's most trusted and largest insurance companies. With millions of policyholders, LIC has a diverse range of insurance products to suit the needs of its customers. To make policy management easier, LIC has launched online services such that policyholders can register and manage their policies online.

My idea through is to ease the steps to register your LIC policy online and provide you with the best access of relevant information quickly.

Registering your LIC policy online has many advantages, including:

Easy Access to Policy Details: Access your policy status, premium due dates, and maturity details at any time, from anywhere.

Convenient Premium Payments: Pay your premiums online via net banking, credit/debit cards, or digital wallets.

Download Policy Documents:

Convenient Premium Payments: Pay your premiums online via net banking, credit/debit cards, or digital wallets.

View and download your policy bond, premium receipts, and other documents.

Track Claims and Bonuses: Check your claims status and accrued bonuses easily.

24/7 Customer Support: Access LIC's online customer support for questions and assistance.

Steps to Register Your LIC Policy Online

Track Claims and Bonuses: Check your claims status and accrued bonuses easily.

24/7 Customer Support: Access LIC's online customer support for questions and assistance.

To register your LIC policy online, follow these easy steps:

Visit the Official LIC Website: Visit the official LIC website at https://ebiz.licindia.in/D2CPM/#Login.

Enter Policy Details: Enter your policy number, premium amount, date of birth, and email ID.

Verify Mobile Number: Ensure your mobile number is registered with LIC, as you will receive an OTP for verification.

Create Login Credentials: Set a username and password for your LIC online account.

Complete Registration: After verifying your details, your LIC online account will be activated.

Once registered, you can log in to your account to manage your policies, pay premiums, and access other services.

Tips for a Smooth LIC Online Registration

Ensure Correct Details: Double-check your policy number, premium amount, and date of birth before submitting the registration form.

Use Registered Mobile Number: Your mobile number must be linked to your LIC policy for OTP verification.

Keep Documents Handy: Have your policy bond and premium receipts ready for reference.

Secure Your Account: Use a strong password and avoid sharing your login credentials with anyone.

Update Contact Information: If your mobile number or email ID has changed, update it with LIC before registering online.

Frequently Asked Questions (FAQs)

Can I register multiple LIC policies under one account?

Yes, you can link all your LIC policies to a single online account.

What if I forget my LIC online account password?

Use the ‘Forgot Password’ option on the LIC customer portal to reset your password.

Is there a fee for registering my LIC policy online?

No, LIC online registration is free of cost.

Can I pay my LIC premium online without registration?

Yes, you can pay premiums as a guest user, but registration is required to access other services.

How do I update my contact details on the LIC portal?

Log in to your account, go to the ‘Profile’ section, and update your mobile number or email ID.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)