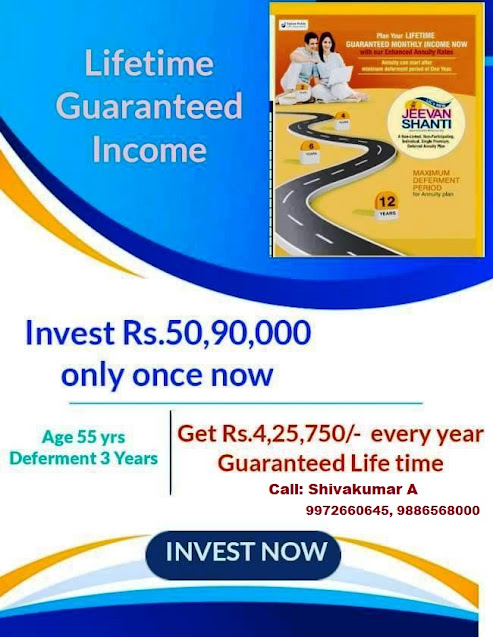

Invest once, get monthly 22, 875*/- for lifetime

In today’s uncertain financial landscape, securing a stable and dependable income for the entirety of one’s life has become a paramount concern for individuals planning their future. In response to this need, LIC (Life Insurance Corporation of India), a trusted name in the insurance sector, offers a solution in the form of the LIC Jeevan Shanti Deferred Plan. This innovative investment avenue not only guarantees a fixed income for life but also ensures substantial returns on investment, providing financial stability and peace of mind for policyholders and their families.

The LIC Jeevan Shanti Deferred Plan stands as a beacon of financial stability and security in an uncertain world. By offering a unique combination of investment growth and lifelong income, the plan empowers individuals to plan for their future with confidence. With guaranteed annuity payouts for life and the potential for substantial returns on investment, the plan ensures that policyholders and their families can enjoy a lifetime of financial well-being and peace of mind. Invest once, secure lifetime income – the LIC Jeevan Shanti Deferred Plan paves the way to a brighter and more secure future.

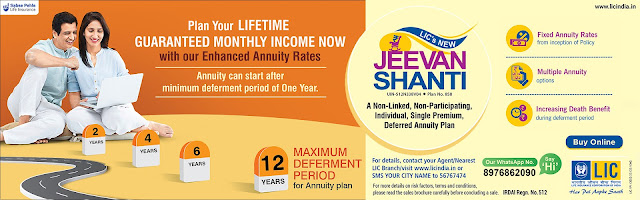

Understanding the LIC Jeevan Shanti Deferred Plan

The LIC Jeevan Shanti Deferred Plan is a unique insurance policy that offers a combination of investment growth and lifelong income. The plan allows individuals to make a single premium payment annually, with the assurance of receiving a fixed amount for the rest of their lives. What sets this plan apart is its deferred annuity feature, wherein the policyholder invests once every year and starts receiving the annuity payouts at a later date, ensuring a steady stream of income during retirement or any chosen phase of life.

Key Features and Benefits of LIC Jeevan Shanti plan

Annual Premium Investment: The policyholder invests a fixed premium amount annually, which accumulates over time to provide substantial returns.

Deferred Annuity Payouts: The unique deferred annuity feature allows policyholders to defer the commencement of annuity payouts until a later date, enabling them to plan their income stream according to their specific needs and financial goals.

Lifetime Income Guarantee: Upon reaching the chosen annuity commencement date, the policyholder starts receiving regular annuity payouts for life, ensuring financial security and stability throughout their lifetime.

Fixed Payout Amount: The plan guarantees a fixed payout amount for life, providing predictability and peace of mind in an uncertain financial environment.

Flexible Options: Policyholders have the flexibility to choose from various annuity options, including single life, joint life, with or without return of purchase price, ensuring that the plan aligns with their individual requirements and preferences.

Tax Benefits: The premiums paid towards the LIC Jeevan Shanti Deferred Plan are eligible for tax deductions under Section 80C of the Income Tax Act, providing additional savings for the policyholder.

Loan Facility: In times of financial need, policyholders have the option to avail of a loan against the policy, providing liquidity without surrendering the plan.

How to start LIC Jeevan Shanti plan from India and outside India

Meeting the LIC agent face to face before purchasing a policy is essential for understanding the terms and benefits thoroughly. It allows for personalized guidance tailored to individual needs. Additionally, it's wise to refrain from buying insurance or investments online from known acquaintances to avoid potential conflicts of interest. A face-to-face meeting ensures clarity, transparency, and the opportunity to ask questions directly, safeguarding one's financial interests and promoting informed decision-making.