Buying Insurance Policies Online

Buy LIC New policy - Call: 9886568000

In today's fast-paced world, convenience is key, and what could be more convenient than purchasing insurance policies online? Whether you're considering life insurance for financial security, tax savings, or investment purposes, the digital landscape offers a plethora of options to explore. In this article, we delve into the realm of online insurance purchases, focusing on life insurance, tax benefits, claims settlement, sovereign guarantees, lifetime coverage, guaranteed pensions, fixed income options, buying LIC new policies, NRI insurance, and investment plans, addressing frequently asked questions along the way.

Life Insurance: Protecting Your Loved Ones

Life insurance serves as a safety net, providing financial protection to your loved ones in the event of your demise. By purchasing a life insurance policy online, you can secure your family's future with ease. Whether you opt for term insurance, whole life policies, or endowment plans, the digital platform offers a seamless buying experience, allowing you to compare different policies, premiums, and benefits at your convenience.

Save Tax, Secure Future: The Dual Benefit

One of the significant advantages of life insurance is its tax-saving potential. Premiums paid towards life insurance policies are eligible for tax deductions under Section 80C of the Income Tax Act, providing you with dual benefits – financial security and tax savings. By buying insurance policies online, you can effortlessly avail of these tax benefits while ensuring your family's financial well-being.

Best Claims Settlement: Ensuring Peace of Mind

Claims settlement is a critical aspect of any insurance policy. When purchasing insurance online, it's essential to choose a provider with a reputation for best-in-class claims settlement. Look for insurers with high claim settlement ratios and prompt customer service to ensure a hassle-free experience for your nominees in the event of a claim.

Sovereign Guarantee: Backed by the Government

One of the distinguishing features of certain insurance policies, such as those offered by LIC (Life Insurance Corporation of India), is the sovereign guarantee provided by the government. This guarantee ensures the safety and security of your investments, offering peace of mind to policyholders. When buying insurance online, consider opting for policies with a sovereign guarantee for added financial protection.

Lifetime Insurance: Security Beyond Boundaries

Lifetime insurance, also known as whole life policies, provides coverage for the entire duration of your life, offering financial security to your dependents even after your demise. By purchasing lifetime insurance online, you can safeguard your family's future with a few clicks, ensuring uninterrupted coverage throughout your lifetime.

Guaranteed Pension and Fixed Income: Securing Retirement

Planning for retirement is crucial, and guaranteed pension plans offer a reliable source of income post-retirement. By investing in pension plans online, you can enjoy a fixed income stream during your golden years, ensuring financial stability and independence. Explore different pension options, such as annuity products and retirement solutions, to find the best fit for your needs.

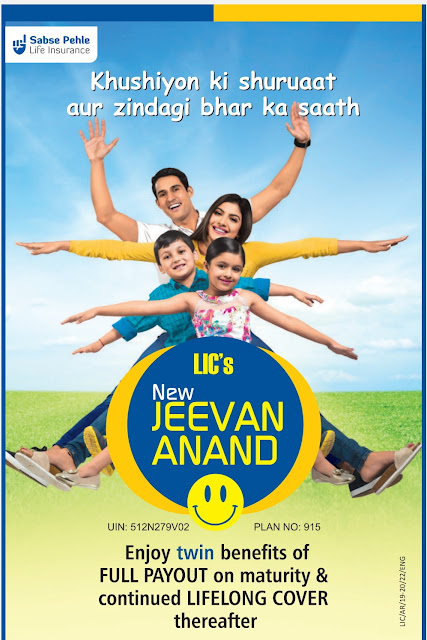

Buy LIC New Policy: Trusted by Millions

LIC, India's largest life insurance provider, offers a wide range of policies catering to diverse needs and preferences. Whether you're looking for term insurance, investment plans, or child education policies, LIC has something for everyone. By buying LIC new policies online, you can benefit from their decades of expertise and trust, securing your family's future with confidence.

NRI Insurance and Investment Plans: Bridging the Gap

For non-resident Indians (NRIs), insurance and investment planning can be complex due to regulatory and tax implications. However, with the advent of online insurance purchases, NRIs can now explore a variety of insurance and investment options tailored to their specific requirements. From NRI insurance policies to investment plans offering attractive returns, the digital platform offers convenience and accessibility to NRIs worldwide.

FAQs: Addressing Common Queries

Can I buy insurance policies online? Yes, most insurance companies offer online purchasing options through their websites or mobile apps, allowing you to compare, select, and buy policies conveniently.

What are the tax benefits of life insurance? Premiums paid towards life insurance policies are eligible for tax deductions under Section 80C of the Income Tax Act, up to a certain limit.

How important is claims settlement ratio when choosing an insurer? Claims settlement ratio indicates the percentage of claims settled by an insurer compared to the total number of claims received. A higher ratio implies better claims settlement practices.

What is sovereign guarantee, and why is it important? Sovereign guarantee is a promise by the government to honor the obligations of an insurer. It ensures the safety and security of policyholders' investments, providing them with confidence and peace of mind.

What are the advantages of lifetime insurance policies? Lifetime insurance policies offer coverage for the entire duration of your life, providing financial security to your dependents even after your demise. They offer peace of mind and uninterrupted coverage throughout your lifetime.

How can NRIs buy insurance and investment plans online? NRIs can explore various insurance and investment options offered by Indian insurers through their online platforms. They can select policies that suit their specific requirements and complete the purchase process online.

In conclusion, buying insurance policies online offers convenience, accessibility, and security, making it easier than ever to protect your loved ones and secure your financial future. Whether you're seeking life insurance, tax savings, guaranteed pensions, or investment opportunities, the digital platform offers a wealth of options to explore, ensuring peace of mind and prosperity for you and your family.