Income tax benefits to salaried and Business owners

Navigating through the Indian Income Tax Act can be daunting, but it’s essential to understand the various sections that allow for tax deductions and exemptions. These provisions can significantly reduce your tax liability if utilized correctly. Here’s a detailed look at some of the most important sections you can leverage to save on taxes in India.

Section 80C: Deductions on Investments

Section 80C is one of the most popular sections for tax-saving. Under this section, you can claim deductions up to ₹1.5 lakh per annum by investing in specific instruments. Some of the eligible investments include:

- Public Provident Fund (PPF)

- Employee Provident Fund (EPF)

- National Savings Certificates (NSC)

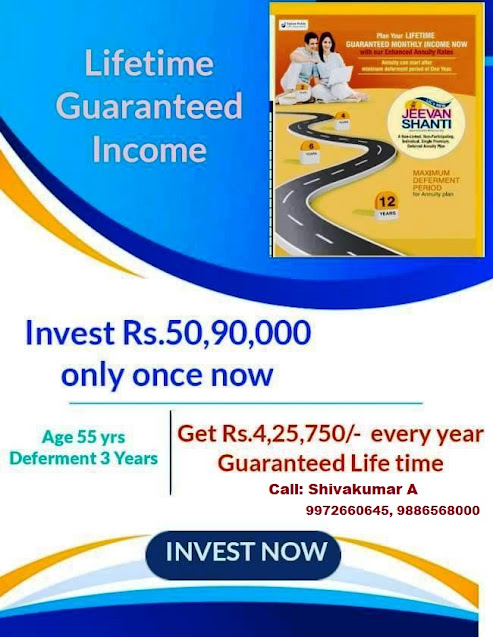

- Life Insurance Premiums

- Tax-saving Fixed Deposits

- Equity Linked Savings Scheme (ELSS)

- Principal Repayment on Home Loan

By carefully selecting and maximizing these investments, you can significantly reduce your taxable income.

Section 80D: Deductions on Medical Insurance

Section 80D offers deductions for premiums paid on medical insurance. This includes:

- Premiums for self, spouse, and children: Up to ₹25,000 per annum.

- Premiums for parents: An additional ₹25,000 (₹50,000 if they are senior citizens).

Thus, if you pay premiums for your family and senior citizen parents, you can claim a total deduction of up to ₹75,000.

Section 80CCD (1B): Additional Deduction for NPS

This section provides an additional deduction of ₹50,000 for contributions to the National Pension System (NPS). This is over and above the ₹1.5 lakh deduction available under Section 80C. Investing in NPS not only helps in saving taxes but also builds a retirement corpus.

Section 24: Deductions on Home Loan Interest

Under Section 24, you can claim a deduction of up to ₹2 lakh on the interest paid on home loans for a self-occupied property. For let-out properties, there is no upper limit, but the overall loss that can be claimed under the head 'Income from House Property' is capped at ₹2 lakh.

Section 80E: Interest on Education Loan

Section 80E allows for a deduction on the interest paid on education loans. This deduction is available for up to 8 years or until the interest is fully paid, whichever is earlier. The loan should be taken for higher education for self, spouse, children, or a student for whom the individual is a legal guardian.

Section 80DDB: Medical Treatment for Specified Diseases

Section 80DDB provides deductions for medical expenses incurred for the treatment of specified diseases such as cancer, AIDS, neurological diseases, etc. The maximum deduction is ₹40,000 for individuals below 60 years and ₹1 lakh for senior citizens.

Section 80U: Deduction for Disabled Individuals

This section provides deductions for individuals with disabilities. The amount of deduction is ₹75,000 for individuals with disabilities and ₹1.25 lakh for individuals with severe disabilities (80% or more).

Section 80G: Donations to Charitable Institutions

Under Section 80G, you can claim deductions for donations made to specified funds and charitable institutions. The deduction can be 50% or 100% of the donation amount, depending on the institution. Notably, donations above ₹2,000 should be made in modes other than cash to qualify for deduction.

Section 80GGA: Donations for Scientific Research or Rural Development

Section 80GGA allows for deductions on donations made for scientific research or rural development. The entire amount donated is eligible for deduction, provided the donation is not made in cash exceeding ₹10,000.

Section 80GGC: Donations to Political Parties

Section 80GGC provides deductions for contributions made to political parties or electoral trusts. There is no upper limit on the amount of deduction, but donations must be made through non-cash modes.

Section 80GG: Deductions for House Rent Paid

Section 80GG is for individuals who do not receive House Rent Allowance (HRA) but pay rent for accommodation. The deduction amount is the least of the following:

- ₹5,000 per month

- 25% of total income

- Actual rent paid minus 10% of total income

Example Scenario

Let's illustrate these deductions with an example. Assume Mr. Raj, a 35-year-old salaried employee, has the following financial details for the financial year:

- Gross Income: ₹12,00,000

- Investments in PPF and ELSS: ₹1,50,000 (under Section 80C)

- Medical Insurance Premiums for family: ₹30,000 (under Section 80D)

- Contribution to NPS: ₹50,000 (under Section 80CCD (1B))

- Home Loan Interest Paid: ₹2,00,000 (under Section 24)

- Education Loan Interest Paid: ₹40,000 (under Section 80E)

- Donation to PM Relief Fund: ₹10,000 (under Section 80G)

Here's how Raj can save on his taxes:

Deductions under Section 80C:

- ₹1,50,000

Deductions under Section 80D:

- ₹25,000 (self, spouse, children)

- ₹25,000 (parents)

- Total: ₹50,000

Deductions under Section 80CCD (1B):

- ₹50,000

Deductions under Section 24:

- ₹2,00,000

Deductions under Section 80E:

- ₹40,000

Deductions under Section 80G:

- ₹10,000 (Assuming 100% deduction for PM Relief Fund)

Total Deductions:

- ₹1,50,000 (80C)

- ₹50,000 (80D)

- ₹50,000 (80CCD (1B))

- ₹2,00,000 (Section 24)

- ₹40,000 (80E)

- ₹10,000 (80G)

Total: ₹5,00,000

Taxable Income:

- Gross Income: ₹12,00,000

- Total Deductions: ₹5,00,000

- Net Taxable Income: ₹7,00,000

By utilizing these sections, Mr. Raj can significantly reduce his taxable income from ₹12,00,000 to ₹7,00,000, thereby saving a substantial amount on his taxes.