LIC New policy 1000 per month

LIC buy new Life Insurance policy Guaranteed Returns, Double Accident Benefit, and Lifetime Insurance for Just Rs. 1000/- Per Month

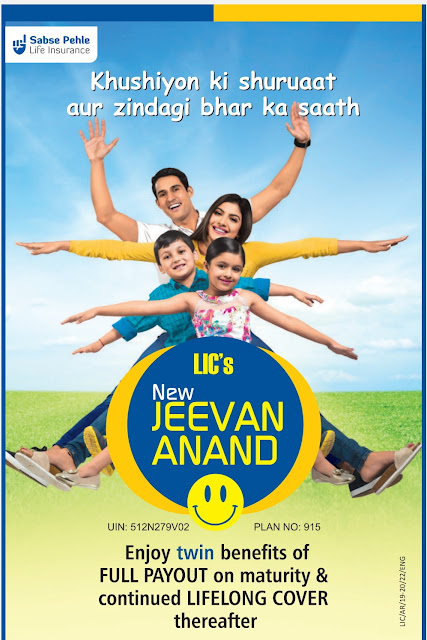

In an era where financial security and stability are paramount, Life Insurance Corporation of India (LIC) has introduced a groundbreaking new policy that offers a myriad of benefits at an affordable price point. For just Rs. 1000 per month, individuals can now secure their future with LIC's new policy, which promises guaranteed returns, normal and double accident benefits, and lifetime insurance coverage. This article explores the key features and benefits of LIC's new policy and why it represents an attractive investment option for individuals seeking comprehensive financial protection.

Guaranteed Returns:

One of the standout features of LIC's new policy is the assurance of guaranteed returns on investment. In an environment marked by market volatility and economic uncertainties, the promise of guaranteed returns provides policyholders with peace of mind and financial security. Regardless of fluctuations in the market, policyholders can rest assured that their investments will yield steady and predictable returns over time.

Normal and Double Accident Benefit:

In addition to guaranteed returns, LIC's new policy offers both normal and double accident benefits, providing an added layer of protection for policyholders and their families. In the unfortunate event of an accident leading to disability or death, policyholders are entitled to receive a lump sum payment, thereby ensuring that their loved ones are financially protected and provided for during challenging times. The double accident benefit further enhances this coverage, offering increased financial support in the event of an accident, thereby providing policyholders with greater peace of mind and security.

Lifetime Insurance Coverage:

Another compelling feature of LIC's new policy is the provision of lifetime insurance coverage. Unlike traditional insurance policies that may have a limited term, this policy offers coverage for the entire lifetime of the policyholder, ensuring that individuals are protected against unforeseen circumstances throughout their lives. Whether it's providing financial support to loved ones in the event of the policyholder's demise or securing funds for retirement and other long-term goals, the lifetime insurance coverage offered by LIC's new policy provides individuals with comprehensive and enduring protection.

Affordable Premium:

Despite offering a wide range of benefits, LIC's new policy remains highly affordable, with premiums starting at just Rs. 1000 per month. This affordability makes it accessible to a wide range of individuals, including those with modest incomes or budgetary constraints. By investing a nominal amount each month, individuals can secure their future and that of their loved ones, thereby laying the foundation for long-term financial stability and prosperity.

In an increasingly uncertain world, insuring himself is the best to secure the future. Securing one's financial future has never been more important. LIC's new policy offers a compelling solution, providing individuals with guaranteed returns, normal and double accident benefits, and lifetime insurance coverage at an affordable price point. Whether it's protecting loved ones against unforeseen circumstances, securing funds for retirement, or achieving long-term financial goals, LIC's new policy provides individuals with the peace of mind and security they need to navigate life's uncertainties with confidence. With its attractive features and affordable premiums, LIC's new policy represents a prudent investment option for individuals seeking comprehensive financial protection and peace of mind.

.jpg)